Asians encouraged to invest in BCP, Fidelidade “in return for residence visas”

A venture capital fund linked to Chinese multinational conglomerate, Fosun, is looking for investors in Asia, especially in China, to invest in Portugal’s BCP bank and Fidelidade insurance group (which is owned by Fosun itself).

With this investment, writes Lusa, the fund is highlighting investors’ access to ‘gold residence visas’.

In the presentation to potential investors, to which Lusa has had access, the Aster Golden Future Portugal Fund states that investors must invest a minimum of €500,000 and fulfil requirements to access gold residence visas (permits that are longer issued for house purchases, but which remain accessible for investment activities, such as subscribing to units in investment funds).

The presentation also gives information about Portugal – such as public services, the cost of private schools and tax advantages – and indicates that it is easy for Chinese immigrants to become integrated.

According to the document, Aster Golden Future Portugal fund is managed by STAG Fund Management and has Fosun International Assets Management (a Fosun Group company) as its investment advisor.

The fund’s custodian bank is BCP, the legal adviser is CMS and the auditor is Deloitte.

The fund indicates that it invests in stable, low-risk financial products, such as bonds that allow for capital growth.

The presentation explains the capital allocation plan, which mainly involves investing in Fidelidade (60% of the value) and BCP (30% of the value) and the prospect of high rates of return (around 9% and 8% respectively).

Management fees are 3.5% per year.

Finally, as is usual with risk funds, the presentation says that there is no guarantee that the investment strategy will work effectively and that each investor should assess their ability to invest.

Lusa contacted the financial markets regulator, the Portuguese Securities Market Commission (CMVM), asking whether it sees any conflicts of interest in a fund linked to Fosun investing in assets held by Fosun itself – and having as depositary a bank in which Fosun is the main shareholder.

In response, the CMVM said that this is a venture capital fund and that it is registered (the public register can be consulted) and that the CMVM is responsible for supervising, among other things, “compliance with the prudential and behavioural requirements applicable to management entities and funds under management”.

The CMVM also cites the Asset Management Regime, which states that “investment in venture capital is considered to be the acquisition of equity instruments and debt capital instruments in companies with high development potential, as a way of benefiting from the respective value enhancement”.

The Asset Management Regime equally states that the fund management company is responsible for “avoiding, identifying, managing and monitoring, at all times, any conflicts of interest and ensuring that participants are treated fairly, without prejudice to the CMVM’s corresponding supervisory powers”.

Management company STAG told Lusa that it is “exclusively responsible” for managing the fund and making investment decisions and that it “acts independently” in the “best interests of its investors and in compliance with current legislation and regulations”. It added that it analyses conflict of interest issues in the “best interests of investors”.

With regard to Fosun, STAG said that it “acts exclusively as the fund’s investment advisor”.

Lusa also contacted Fosun (asking about conflicts of interest and whether it intends to reduce its holdings in BCP and Fidelidade), but Fosun referred explanations to STAG because – it said – it only acts as a consultant to the fund.

BCP said that it does not comment on issues related to clients and that its service as a custodian bank “fully observes all the regulations in force, particularly with regard to the identification and prevention and, where appropriate, reinforcement of the supervision of processes relating to situations that may in any way indicate potential conflicts of interest”.

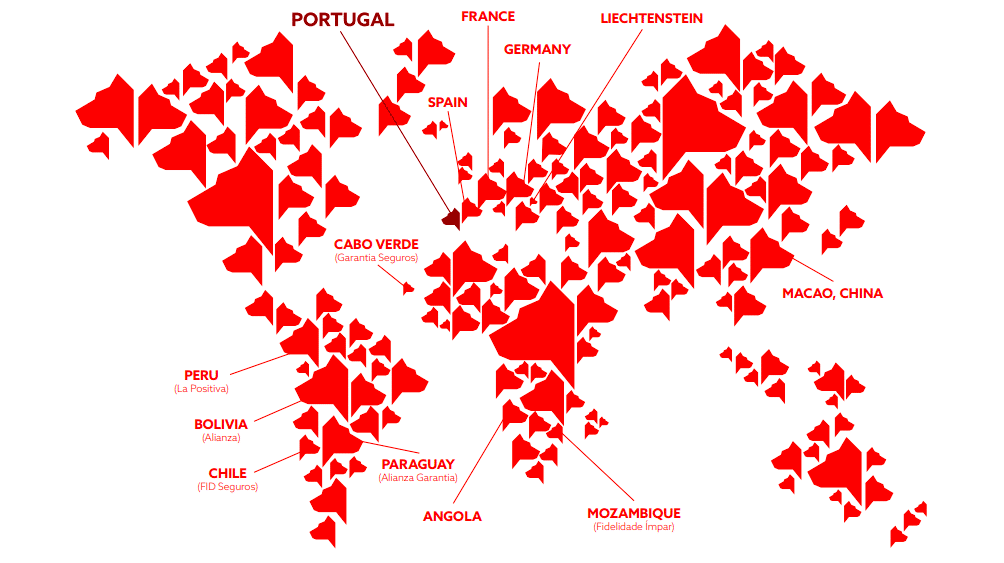

As Lusa explains, “in Portugal, the Chinese group Fosun owns Fidelidade (85% of the capital), Luz Saúde (owned by Fidelidade) and 5% of REN, the electricity and gas network manager (through Fidelidade).

Fosun is the largest shareholder in BCP, with around 20%.

Fosun used to have around 25% of BCP’s capital, but at the beginning of the year it sold down part of its shares and since then markets have speculated that the group is considering reducing its stake in the bank further.

In recent years, the Fosun group has accelerated the sale of assets to strengthen liquidity due to its high debt (at the beginning of the year the conglomerate had a debt of US$40 billion (around €36 billion at the current exchange rate) and the pressure it has felt from the bond market.

A source close to Fosun told Lusa that it wants to remain a reference investor in BCP and that it also maintains its commitment to the Portuguese market in Fidelidade.

Complicating the picture perhaps is the fact that Fosun is also one of many ‘private Chinese companies’ seen as being part of an ecosystem of Chinese party-state actors that have sought to embed themselves in (in this case) Portugal’s financial system, “creating a foothold to widen China’s financial presence within the country and beyond”.

According to a report published two years ago, entitled: “CCP Inc in Portugal” Fosun’s investments in Portugal provide insight into the Chinese Communist Party’s activism in shaping the business environment for private sector players and potentially leveraging its presence within the Portuguese financial sector to support China’s wider geopolitical and global commercial ambitions throughout Belt & Road (BRI) initiative countries and Latin America.

Source: LUSA/ CSIS