IRS 2017 – Expenses 1-6 || Donations to charity

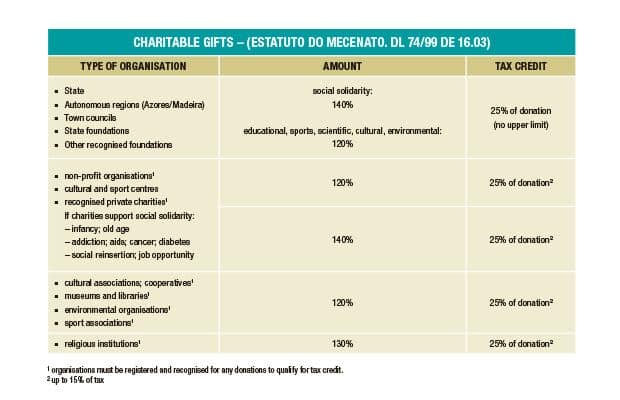

Tax credits for charitable gifts for individuals are based on the “estatuto de mecenato” (patronage statutes), which divides contributions according to the nature of the charity. The amount of the

Tax Credits for Housing || Nº 4

|| IRS 2017 – Expenses 1-6 The IRS tax code offers partial tax credits for housing costs within Portugal. Unusual in the international context is the fact that domestic legislation

IRS 2017 – Medical Expenses || Nº2

How can I save on my taxes? Of all the credits and deductions available, medical expenses are customarily the single largest for most taxpayers. In 2017, the tax credit is

Tax savings with discount cards and vouchers

If you work for a company that helps with the cost of lunches, daycare tuition, schooling and nursing home costs, you should consider using these allowances in the form of

Car importation online

The procedures of customs clearance and payment of the tax on vehicles have been simplified, now to be done electronically online in most cases (new rules take effect on July

The Delaware Papers

2. Why move a Delaware Company to Portugal Offshore has become a “four-letter word” throughout the EU in recent years. Properties held in Delaware Companies, for example, once a popular

The Delaware Papers

1. Delaware classified as opaque jurisdiction According to financial standards of opacity, Delaware has the dubious honour of being classified amongst the top “least transparent tax havens” as determined by

An ominous letter from the Tax Office

As a resident foreigner, you may receive letters from the Tax Office (Autoridade Tributária). Just as happens with many Portuguese citizens, you will be baffled by the encrypted content, written

|| IRS 2016 – Taxation of Income nº6: Holiday lets as a business (Category B)

Income is reported in different categories: A) Salaries B) Sole traders E) Capital F) Property G) Capital Gains H) Pensions – and is taxable in Portugal regardless of its origin.

IRS 2016 – Taxation of Income nº5: Rental Income – Long-term rentals (Category F)

Income is reported in different categories: A) Salaries B) Sole traders E) Capital F) Property G) Capital Gains H) Pensions – and is taxable in Portugal regardless of its origin.