Say banks’ “extraordinary profits” should filter down to rank and file

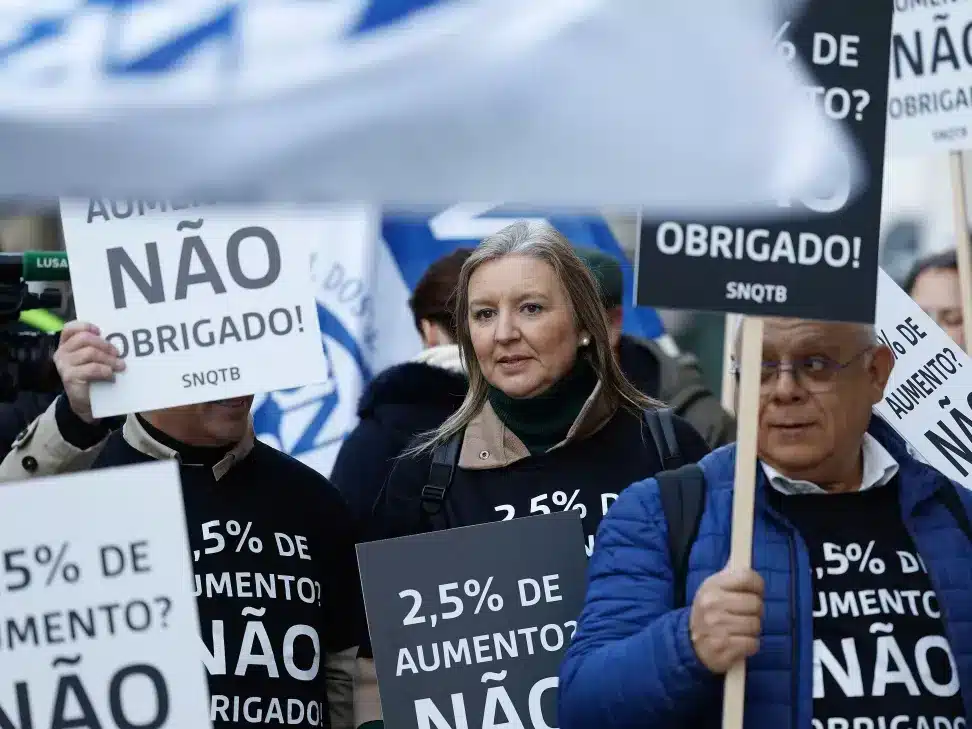

Bank workers in Portugal and Spain are taking to the streets today in a “unified cry of dissatisfaction”. They are calling for improved salaries and better working conditions in the face of banks’ “extraordinary profits”.

The protest in Portugal is scheduled for 2pm this afternoon, in front of the headquarters of the Portuguese Banking Association (APB) in Lisbon, while Spanish counterparts will be protesting in Madrid.

According to the various unions and syndicates involved, after the years of the troika, where banking staff were considered “fundamental pillars” of the financial sector, they are now “treated like slaves” in spite of the banks’ historic profits, benefiting from rising interest rates.

Of the five big banks operating in Portugal, Santander Totta, Novo Banco and BPI have already presented their accounts for 2023, with profits rising to €1,030 million, €743 million and €524 million respectively. Caixa Geral de Depósitos (CGD, the State bank) and BCP have yet to present their figures, but data up to September (CGD made a profit of €987 million and BCP €651 million) suggests 2023 will surpass records from 2007, when the ‘big five’ made a combined profit of almost €2.9 billion.

“While workers face precarious conditions, extraordinary profits flow into the hands of shareholders, many of whom are foreigners,” the unions complain – adding that the banks are experiencing a working environment that overburdens workers, who are fewer and fewer (due to staff cuts) and have to do work required, often without being paid overtime.

For this year, unions are demanding a 6% salary increase (while banks that subscribe to the sector’s Collective Bargaining Agreement are proposing 2%). This is what has led to today’s outpouring of anger and frustration.

“Informally, according to sources in the sector who spoke to Lusa, banks accept that the increase will be above 2%, but not by much” (in 2022, banks proposed increases of 4% and reached an agreement of 4.5%).

For the unions calling today’s protests, bank employees cannot “accept being treated like pawns in a game where real human value is being disregarded”. It is up to the banks, and regulatory authorities, to understand that decent salaries and careers are “essential to keep the banking sector healthy and fair”.

Banking profits have been talked about in the current pre-election campaign, but without dominating the debate, says Lusa.

In their electoral programmes, among other proposals, PCP communists want to see extraordinary taxation of banks’ profits; Liberal Initiative defends the end of the additional solidarity tax and the privatization of CGD and Bloco de Esquerda wants CGD to intervene so that banks can lower interest rates on mortgage loans.

As Lusa points out, AD, PS, Chega and PAN have yet to present their electoral programmes, “which will happen in the next few days”.

There are around 40,000 bank workers in Portugal and 140,000 in Spain.

Source material: LUSA